The article (http://mypalmoil.blogspot.com) “Palm oil prices sizeably undervalued, says Mielke ”, published on Monday, September 24, 2012, discusses the market demand and supply of palm oil in effect to the lower price of palm oil compared to soyabean oil. Currently, the price of soyabean oil is estimated at US$1,170.43 per metric ton and the price of palm oil at US$872.25 per metric ton (Index Mundi, 2012). According to Thomas Mielke, editor of Hamburg-based newsletter Oil World and former member of the Programme Advisory Committee of the Malaysian Palm Oil Board, the price of palm oil is offered at a discount of US$298.18 less of soyabean oil is unlikely sustainable and the world import demand will shift to the more effectively priced palm oil.

To further understand the market; demand and supply of palm oil, it is important to know how palm oil is produced and for whom it is produced for. Palm crops can only be cultivated in tropical areas such as Indonesia, Malaysia, Thailand, Nigeria and Colombia; the top five palm oil producers. Palm oil is derived from the fruit of the oil palm tree. Palm oil is used in various types of products ranging from margarine, cereals, and sweets to soaps, washing powders and cosmetics. Other uses also include animal feedstuffs and as a bio fuel. The constant demand for palm oil is because of the wide usage of palm oil in various kinds of consumer goods.

In a recent report by StarOnline, the price of palm oil has dropped by 18% to as low as RM2,500 to RM2,600 per tonne in 2012. According to Dorab Mistry, director at Godrej International Ltd, “palm oil, the world’s most-used cooking oil, is poised to tumble to a two-year low as inventories surge in Indonesia and Malaysia, the biggest producers, and a global economic slowdown curbs demand”. The ‘inventories surge’ mentioned refers to a surplus in palm oil production.

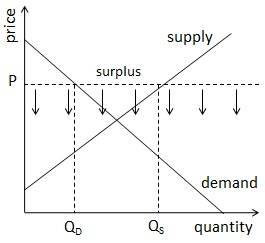

According to Global Industry Analysts, Inc. (GIA), several factors for the rapid growth of oil palm include lower production costs of palm oil in comparison with other crops of similar nature and higher oil produced from a hectare of palm oil plantation than other types of vegetable oils. A Bloomberg survey shows palm oil stockpiles in Malaysia have increased by 10% from 1.7 million tonnes to 1.8 million tonnes between June and August, 2012. Surpluses forces price down as a large surplus would prompt sellers to lower prices that will encourage buyers to take the surplus off their hands. Therefore, the excess supply of palm oil in Malaysia is likely the cause of the drop in price of palm oil that Thomas Mielke mentioned in the article.

An important characteristic of demand is that as price falls, the quantity demanded rises and as price rises, quantity demanded falls, ceteris paribus. Economists call this the ‘law of demand’. This applies similarly to the situation of the price fall of palm oil in Malaysia. As the price of palm oil decreases, the quantity demanded for palm oil increases. However, price only affects the quantity demanded for palm oil, not the demand. A change in demand is affected by other factors other than the price, such as taste, number of buyers, price of related goods and income. A change in demand will shift the demand curve, either right that indicates an increase in demand, or left that indicates a decrease in demand.

One of the determinants that influence the increase in demand of palm oil is the price of related goods, in this case, soyabean oil. Soyabean oil is a substitute good. When two products are substitutes, an increase in the price of one good will increase the demand for the other good, vice versa. Now that the price of palm oil is cheaper than the price of soya bean oil, buyers will buy less of soya bean oil, and buy more of palm oil. Thus, this will increase the demand for palm oil.

The number of buyers is another determinant that influences the demand of palm oil. A rise in the number of buyers is likely to increase product demand. Since the lower price of palm oil in comparison to soya bean oil will attract more buyers to purchase palm oil, this increases the number of buyers for palm oil and will, therefore, push the demand up.

The increased demand will help the world’s top two oil producers – Indonesia and Malaysia – raise exports and trim inventory that has been depressing oil prices. In the situation of a surplus, there is an excess of supply in the market. This means producers are producing more than what consumers are willing to buy. An increased demand will shift the demand curve to the right, thus eliminating the market surplus that has been pushing down palm oil prices.

From my point of view, though the market price of palm oil has dropped and ‘hurt’ the producers of palm oil now that their profit margin is less, the drop in price will help push up the demand for palm oil and reduce the excess stockpiles that has been pushing the palm oil prices down. In other words, it may not be a good thing for producers now, but it will benefit the producers in month’s time. Once the surplus is eliminated, the market price of palm oil will eventually return to its original price and producers will gain better profit as compared to the current situation.

No comments:

Post a Comment