In the article “Lower Excise Cuts Will Hurt Automotive Industry” (http://biz.thestar.com.my/news/story.asp?file=/2012/5/3/business/11220992&sec=business), the executive director of Tan Chong Motor Sdn Bhd (ETCM) says that a negative impact will occur to the automobile industry of Malaysia as a result of the lowering of excise duties as proposed in the upcoming 2013 Budget. He substantiates his claim saying that car dealers and used car buyers would be feeling the pinch of the reduction, as the former would be experiencing unmoving stocks and the latter would experience a decrease in the value of their secondhand cars. Furthermore, he says that excise duty reduction would result to a reduction in the government’s revenue.

An excise is a form of indirect taxation by the government charged on the sale of a particular good, in this case, imported cars. How the burden of this tax is divided among buyers and sellers refers to “tax incidence”, and how this will be determined depends on the elasticity of the particular good. In Malaysia, it is reported that an excise of 75% to 105% is imposed on passenger cars and consumers end up paying more than what they originally should. You’d be shocked to know that these percentages exclude sales taxes, which are also borne by consumers. The reasoning for imposing duties is to act as a protectionist policy to protect the local car industries. However, in the government’s efforts to protect the national automotive industry, social issues such as bankruptcy have arisen. People are in debt not because they bought a car, but because they are paying huge amount of taxes that come along with the car. In fact, it is said that 25% of bankruptcy in Malaysia is due to car loans. It can’t be denied that cutting down excise duties will bring both negative and positive outcomes to consumers, however, in my humble opinion, the good outweighs the bad.

To know the effects of an excise reduction on imported cars, we must first ask, “Are cars in general a necessity in Malaysia?” As our country is experiencing economic growth and is en route to the year 2020, a car can be said as a necessity, especially to those who commute from suburban areas to their workplace in the city as it would ease their journey. This is why JPJ reports a high number of cars in Kuala Lumpur and other states such as Johor, Pahang, Penang and Perak, where labors flock to in promise of better economic opportunities (Figure 1). Take CEOs of a company, for example. Having a car would smoothen the process of going from one appointment to the next. This also lessens the time loss (opportunity cost) they would have incurred if they wait for public transportation. Besides, in Malaysia carpooling isn’t a norm. It’s rare to find colleagues coincidentally living in the same area as you do, which makes carpooling highly unlikely. Aside from that, inefficient public transportation system also reinforces the fact that cars are a necessity in Malaysia.

Figure 1

Thanks to high excise duties, imported cars are sold at an unbelievingly high price in Malaysia as compared to other countries, as shown in Figure 2. An excise reduction would benefit those who are currently searching for an imported car. This would mean that Malaysians can buy imported cars with much easier repayments, lesser bank interest and lower insurance cost, all of which are less taxing to the consumers. This would alleviate their burden in their hopes of obtaining an imported car, especially those who prefer imported cars for safety reasons--there are more airbags in imported cars as compared to local cars or for personal reasons such as viewing these cars as desirable status items that would reflect their lifestyle. Some would even cite better quality and fuel mileage.

Volkswagen (2009 model)

|

Malaysia

|

RM 200,000

|

US

|

RM 85,000

|

China

|

RM 60,000

|

Figure 2

However, for those who already have cars—be it a local or imported car, they will be negatively affected by the excise cuts. Unlike the price of houses and land, vehicles depreciate in value. As a matter of fact, it is said that “a car loses about 30 percent of its value the moment it leaves a showroom” Imagine the value of used cars, which in the first place has depreciated in value in time, and also as a result of the excise cuts. It would be difficult for used car users to resell their car on the market as the value has nosedived, and should they be able to sell it, they would suffer a great loss. However, I think this will only affect them in the short run. The next time they decide to buy a car—an imported one at that, they too will benefit from the excise cuts.

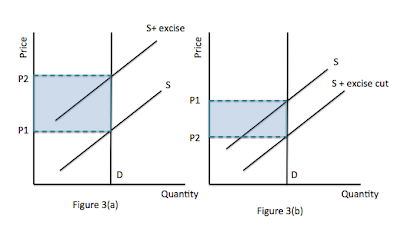

As we’ve discussed, there two markets for cars in Malaysia; national and non-national cars or imported cars. How a reduction in excise duty affects the demand and supply of imported cars would depend on the sensitivity of demand to changes in its price, or in other words, the elasticity of demand of imported cars. We’ve agreed that cars are a necessity in Malaysia, but what about the elasticity of cars? Generally, “people cars” or which in this case refers to national cars, have an elastic demand, as they are cheaper. “Luxury cars”, which in this case refers to imported cars, have a perfectly inelastic demand, as they are pricier after taking excise duties into consideration. People will still go for these items regardless of the price due to personal preferences mentioned above; price has little relation to demand. The effect of high excise tax can be shown in Figure 3(a), and the effect of a reduction in excise tax can be shown in Figure 3(b)

Referring to Figure 3(a), P1 would be the price paid by consumers for imported cars without excise duty. With an excise of 75-105%, P2 is the price consumers are forking out, while P3 is the actual amount received by sellers. Demand would still remain as usual. Those who disagree with the excise cut would argue, what’s the point then, of reducing excise duties? We should keep in mind that the main reason to ease burden of rakyat to buy imported cars. They shouldn’t be paying excessive amounts on taxes.

National car producers are worried about the excise reduction, which it would result in a decrease in the demand for national cars. This is because the cross-elasticity test for national cars and imported cars would yield a positive result, meaning that they are substitutes. A decrease in the price of imported cars would result in the decrease of demand national cars. But in my opinion, they haven’t much to worry about. It doesn’t necessarily mean that people will be queuing outside BMW motor show houses to get their brand new wheels and that national cars would be driven out of business. People high in patriotism would opt for national cars.

It’s true that the reduction would affect the government’s revenue. However, the government realizes the debt implication high excise duties have on citizens, and it’s a sacrifice they must do in order for the benefit of society. Besides, I’m sure they will find new channels for revenue. Aside from that, I think the reduction in excise should be introduced slowly to ensure no sides are hurt. The excise duty change should be done slowly and gently, like taking of a bandage, if you may. Last but not least, I would like to stress that a reduction in excise would be beneficial to consumers.

Did you know you can create short links with AdFly and make $$$$$ for every click on your short urls.

ReplyDelete